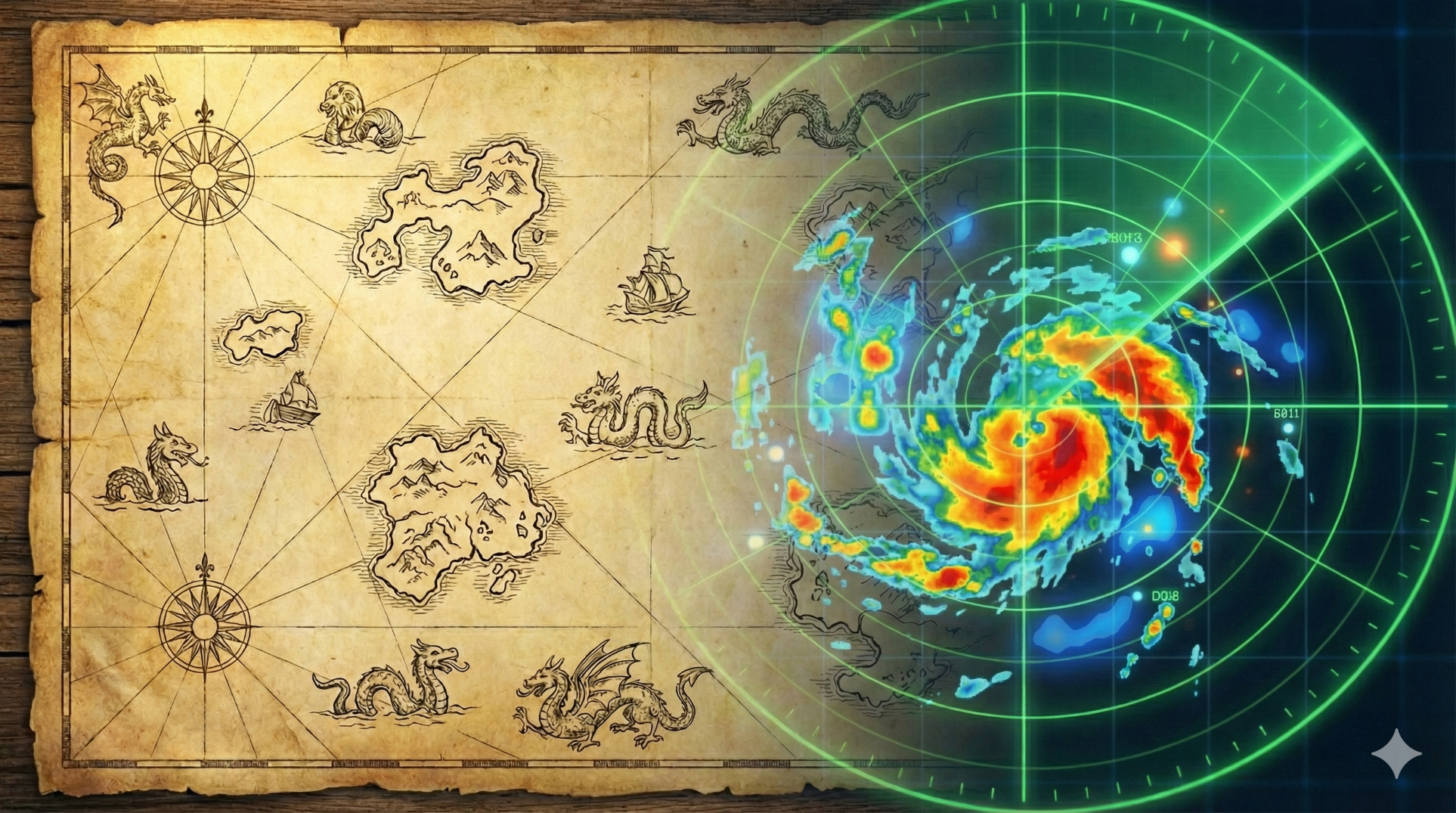

Use a radar.

Not a crystal ball.

How do you act with conviction when nothing is guaranteed? The key is building a repeatable process based on enduring economic and market principles—a radar to help you adapt to change.

Quantitative discipline rooted in timeless economic principles.

At Variant Perception, we search for first principles answers to fundamental investing questions. We draw from diverse sources, from historians, to famous investors, to disease contagion models, and we avoid overfitted black boxes.

We embrace an interdisciplinary approach to see the bigger picture, whether it's spotting macro turning points, tracking the capital cycle, or contextualizing short-term price moves.

A repeatable variant perception requires both quantitative discipline and human intuition.

The Foundations of Variant Perception

Actionable Insight

Research & Charts

We produce forward-looking, actionable reports that interpret and contextualize our quantitative models. Clients also have access to live, updating chart collections — the same data our analysts use for idea generation.

Pro Tools & API

For those who want to dive deeper, we provide apps and a data API that allow clients to run their own analysis and build on our frameworks.

ETF Strategies

Our cycle-aware core allocations are systematic, transparent, and backed by over 15 years of research and development.

Ideas in Action

Stay Connected

Our research is built for investors who need timely, repeatable insights.